It’s the first day of Chinese New Year! Happy Rabbit Year! This is also the time for your kids to collect Hong Bao (and sadly for you to give). But what does this have to do with investment? What do you do with the Hong Bao money, especially if your kids are very young and don’t even have a wallet to spend those money?

Best Savings Accounts

| Bank | Interest Rates | Notes. |

|---|---|---|

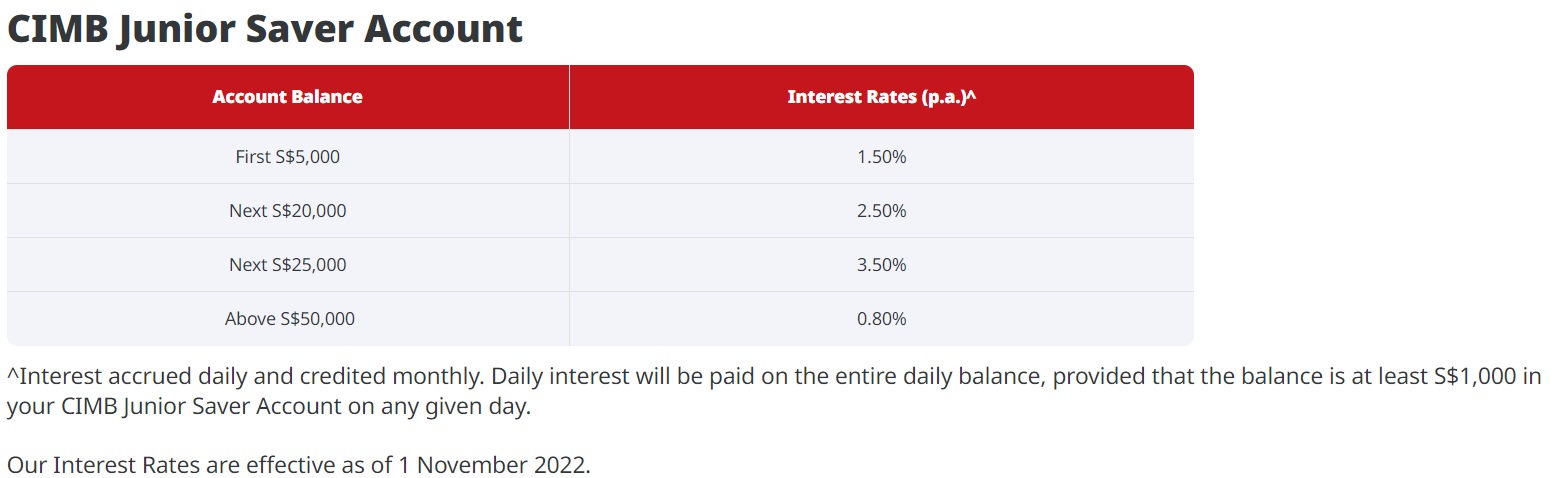

| CIMB Junior Saver Account | 1st 5k: 1.5% Next 20k: 2.5% Next 25k: 3.5% Above 50k: 0.8% |

12yo and below. Min deposit S$1000. |

| Maybank Youngstarz Account | 1st 3k: 0.1875% Next 47k: 0.25% Above 50k: 0.375% |

Min deposit S$10. Includes complimentary insurance. |

| OCBC Mighty Savers Account | base: 0.05% min $50, 0 withdraw in mth: +0.05% with cda: +0.2% |

Below 16yo. |

| Citibank Junior Savings Account | 1st 30k: 0.05% Above 30k: 0.1% |

Below 18yo. |

| POSB My Account | 0.05% | Below 16yo. |

| Standard Chartered e$aver Kids Account | 0.05% | Below 18yo. |

| UOB Junior Savers Account | 0.05% | 16yo and below. |

Updated as of 22 Jan ‘23. Sorted in order of interest rates.

I was quite stunned by the CIMB Junior Saver Account as the interest rates are pretty high, even higher than some of the fixed deposit accounts! Honestly I hope this is correct!

One thing I observe is that it is really quite hard to find interest rates for each of the kids savings account. It is not found by default on most of the pages itself. Sometimes I can’t even find it anywhere on their main sites!

Aside from the CIMB Junior Saver Account, the interest rates for some of the other kids savings accounts are not that high. The next tier is probably the CDA account.

Child Development Account (CDA) Account

It is likely that you have already opened this because of the government co-matching what you put into the account. Unlike the other savings account mentioned above, the CDA account is only active until your child reaches 12 years old. Any left over will be transferred to the Post-Secondary Education Account (PSEA). Interest rates are usually higher there than in normal savings account, but do note you can’t pay for everything using this account, usually Baby Bonus approved institutions, and you can’t withdraw funds normally.

| Bank | Interest Rates | Notes. |

|---|---|---|

| OCBC | 1st 10k: 1.2% Above 10k: 2.4% |

Helps increase OCBC Might Savers account (see above) |

| POSB | 1st 10k: 1% Next 40k: 2% Above 50k: 0.05% |

- |

| UOB | 1st 25k: 1% Next 25k: 2% Above 50k: 0.05% |

- |

Updated as of 22 Jan ‘23. Sorted in order of interest rates.

Did you know the interest rates could change over time? I didn’t, and was surprised to find that out. So it is important to monitor these occasionally and increase your fundings if necessary. I usually do put a bit more in the CDA accounts, especially since the normal savings accounts’ interest rates were lower a few years back.

Summary

Beyond these, there are other options that you can consider, but you would need to put in more funds yourselves (unless your kids’ Hong Bao money is massive!). Lately, due to increased interest rates, there are Singapore Savings Bonds, or T-bills that are safe and worth considering setting aside your money. You can also consider various fixed deposits that are still on the rise, reaching above 4% lately. There are also investment-linked policies, and even stock market options. The latter is a bit more risky in my opinion, especially when the market outlook is quite uncertain this year. Will likely follow-up with some more blog posts on these other options another day!

Here’s wishing everyone have a healthy and happy Chinese new year!

Cover photo from unsplash.com

Tugether Lego Event at Suntec City

Tugether Lego Event at Suntec City